Hello, community! Many of those who closely follow crypto probably saw the tragic news about a well-known Ukrainian crypto influencer over the weekend. We won’t engage in any speculation about this tragedy and understand that only those close to the person will know the truth—our sincere condolences to them.

In any case, there are other, similar situations. So here’s a reminder: markets reopen after any crash—unlike your deposit, which won’t return after liquidation. Never risk your last money—or, worse, someone else’s—when dealing with highly risky assets.

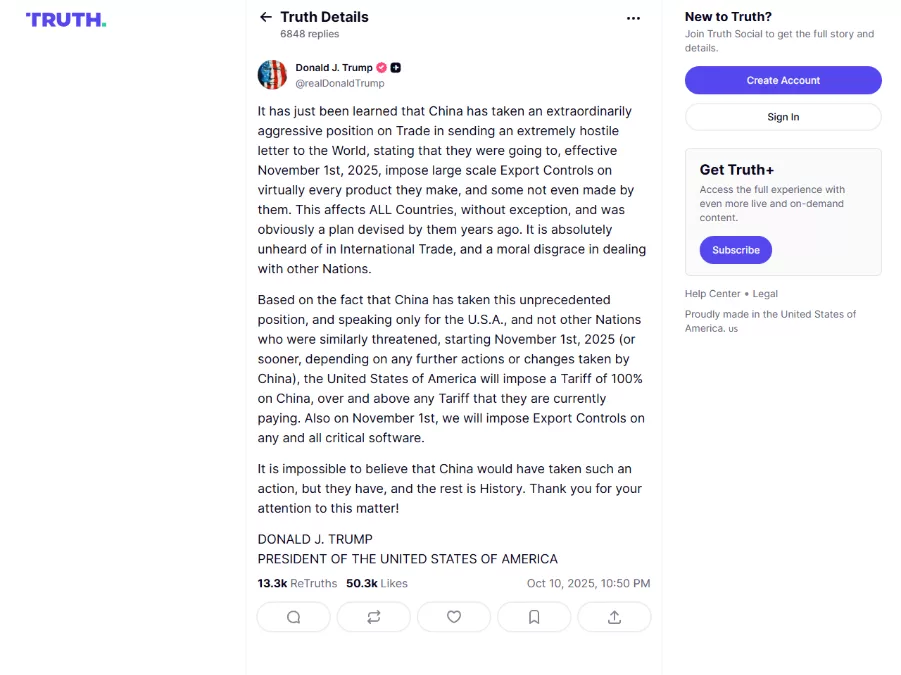

A quick recap: on the night of October 10–11, the crypto market saw one of its biggest drops—at one point BTC fell by more than 20% on the daily timeframe. Why did this happen? The short answer is Trump—specifically his post on his social network, Truth Social.

In short, it was a response to restrictions China had just imposed on U.S. exports—an extra 100% on top of existing tariffs—which immediately rattled the crypto market. Effectively, it sounded like the start of a real trade war.

But! As often happens with our red-haired friend, a new post appeared on October 12 that walked everything back:

Basically: all’s good with China—props to Xi, the party, and all the comrades.

Even now, the market still hasn’t fully recovered from the blow. While some coins are returning to pre-crash levels, the likes of XRP are around $2.60 (vs. ~$3.00 before the drop).

What Caused the Crash, and How Big Was It?

The weekend crash happened due to several factors:

- Trump’s posts. Opinions aside, he’s still the president of the world’s largest economy. When he all but announces a trade war with the other largest economy, markets react.

- Investor fear and panic selling. The sharp drop wiped out long positions on futures, leading to massive liquidations: over 1.6 million positions closed prematurely, totaling more than $19 billion.

- Technical outages. Many exchanges struggled with the surge in transactions—this included Binance, which we’ll discuss shortly.

Crucially, some wallets profited from the fall by entering timely short positions. Users have already surfaced a few such wallets and begun linking them—if not to Donald Trump himself—then to his family or close circle.

It also looked like a deliberate hit on the crypto market specifically: the first and second posts came out over the weekend, when stock markets were closed—so traditional markets avoided major swings.

So was this manipulation by a sitting U.S. president to enrich himself or his associates? From the outside, it certainly looks that way.

And given that two social posts can upend crypto prices entirely, it’s a reminder not to risk your last funds on such a volatile market.

Compensation from Binance

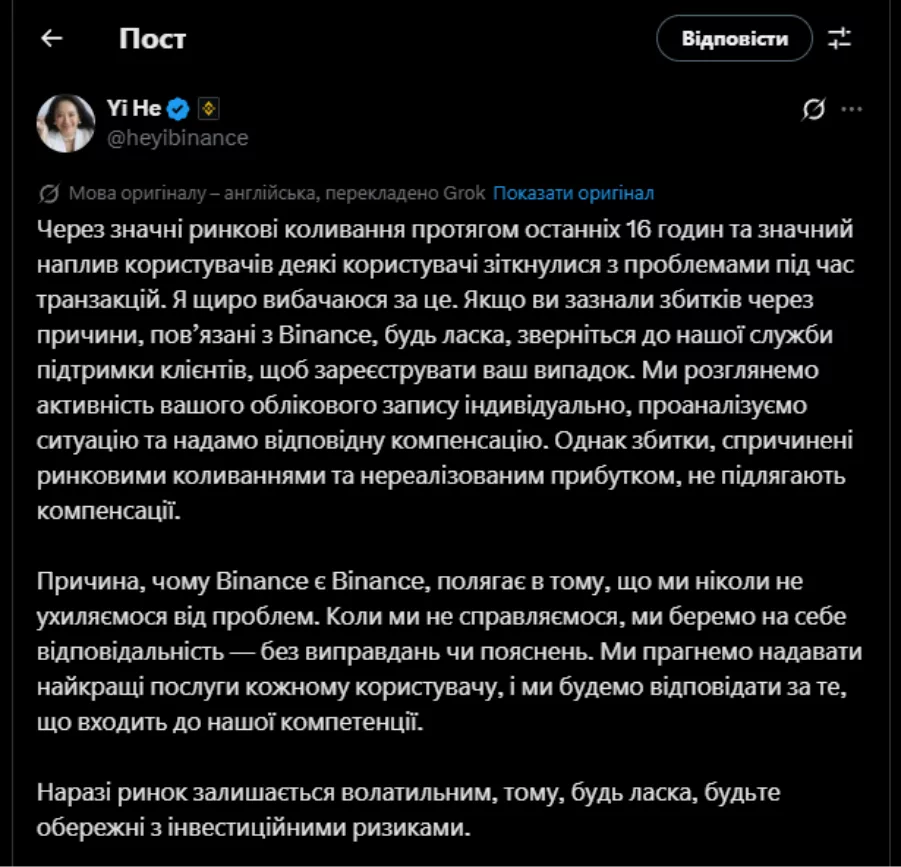

Now, about compensation. Since Monday, reports have circulated that Binance will compensate users who lost funds during the weekend crash. The source was a post by Yi He, who leads Binance’s Chinese business and is a co-founder. Translation attached below:

So what does it mean—will the exchange restore liquidated positions? Yes and no.

They’ll compensate only where losses were caused by exchange-side technical failures. Such cases will be reviewed individually upon request.

Accordingly, if a trader lost money because they didn’t set a stop-loss, there will be no refund—under any circumstances. But if a position was liquidated due to technical issues, there’s a chance to recover funds.

Yi He’s post addressed a specific case: amid extreme market load, there was a brief depeg in stablecoins like FDUSD and USDT due to liquidity shortages—the trading volume was so high that supply couldn’t keep up with demand.

Depeg is when a token loses its peg to the underlying asset—e.g., a stablecoin to the dollar, or BNSOL to Solana, etc.

In general, the depeg also affected wBETH, BNSOL, and USDe.

Conclusion

Will you get your money back if your position “burned” because of market volatility? No. But if you believe your position was liquidated due to an exchange-side technical failure, definitely contact support—your case might qualify for compensation!

As for the market itself, it’s starting to recover. Optimistic new-ATH forecasts are back in the air—supported, among other things, by technical analysis. But can TA predict Trump’s next post? That’s a rhetorical question.

To stay on top of the latest crypto news, subscribe to CryptoҐik—always fresh and relevant updates!

Sincerely, your Geek!