Hello, community! The world of cryptocurrency is rapidly evolving, drawing more and more attention from the public. Even presidents are fueling the hype. After all, almost everyone who’s even slightly into the news has heard of the $TRUMP coin — and not just crypto news.

Today, let’s talk about the phenomenon of the $TRUMP coin, why the new U.S. administration has every chance to shake up the crypto world, and why Bitcoin started pumping right after Trump’s election victory. But first things first.

Also, a quick reminder — we recently covered what memecoins are and why they’re so popular. Highly recommended!

Why BTC Pumped After Trump’s Election Win

It just so happened that this year’s U.S. election coincided with the Bitcoin halving. Most experts expected BTC to hit new all-time highs next year — but the presidential race changed the game.

Trump’s victory, the people he brought into his administration, and the crypto-friendly narratives he pushed all played a role. For one, Trump repeatedly emphasized that the U.S. must stay ahead of China in the crypto race. On top of that, the new administration features none other than Elon Musk — arguably America’s top crypto evangelist.

During his campaign, Trump also called for the creation of a national crypto reserve. Analysts speculate this reserve could be based on seized digital assets, including tens of thousands of BTC and other coins like LTC, formerly tied to Silk Road.

Combine all that with relative economic stability in the U.S., and you get increased investor trust in crypto — leading to new ATHs.

Is the New U.S. Government Really “Pro-Crypto”?

If you’ve ever browsed Binance Square, you’ve probably seen more than just people praying for their favorite coin to moon. It’s full of posts saying a “pro-crypto” president is finally in office and will set things straight. But is that true?

Trump has publicly supported cryptocurrency on multiple occasions, showing he takes digital assets seriously. However, he didn’t mention crypto much during his inauguration — only briefly saying the U.S. should lead the crypto charge. But what about others in his circle?

Enter Cynthia Lummis — a long-time crypto advocate in the Senate, even before it was trendy. She once proposed a strategic reserve of over 1 million BTC, accumulated in the same way the Federal Reserve buys gold to manage national debt.

Lummis is now chair of the Senate subcommittee on digital assets. That means she’ll directly influence how the U.S. government interacts with blockchain — a huge plus for anyone holding BTC or any other crypto.

There’s also David Sacks, entrepreneur and former PayPal exec, appointed by Trump to oversee crypto and AI policy. The media now calls him the White House’s “Crypto Czar.”

Even the Federal Reserve — historically crypto-hostile — could see changes. Its current chair, Jerome Powell, is set to finish his term in May 2026, but Trump might have other plans.

Trump’s inner circle is also crypto-friendly: Elon Musk will lead the new Government Efficiency Office (which some say intentionally abbreviates to DOGE — a nod to the meme coin), and even Trump’s own son is on board.

All of this fuels investor confidence that crypto-friendly attitudes will lead to favorable regulations. And you can see that belief reflected in the market charts… or maybe you can’t?

Will the $TRUMP Token Kill Crypto?

Now let’s talk about the coin itself — $TRUMP. While it’s closely tied to the U.S. president, it’s still a memecoin. But one that spiraled completely out of control.

$TRUMP was launched in January this year, announced directly by Donald Trump himself. While many were hesitant to click the link, suspecting a hack, others jumped in — and may now be house hunting.

The coin was launched on the Solana network, which helped push SOL to a new ATH — nearly $300 per token.

$TRUMP shook the market, wiping out many other memecoins. At its peak, its market cap topped $68 billion — despite having only 200 million tokens in circulation. The remaining 800 million are still locked.

Its ATH? Around $78. Anyone who bought at the top probably regrets it — it’s now hovering around $10.

Still, $TRUMP taught us two things:

- Hype and speculation can generate insane profits — if you’re in the right place at the right time. The coin gained over 10x from launch price.

- Market manipulation is very real — especially if you’ve got a massive following… or you’re the U.S. president.

But this last point may come back to haunt the market. Soon after $TRUMP, a $MELANIA token launched — but it never even made it to Binance spot listings. You can only trade it on futures.

Holders of other memecoins were furious. Many sold their bags to buy into $TRUMP — crashing coins like WIF, which still hasn’t recovered.

Then there’s the 800 million locked tokens. Despite promises that they’ll unlock gradually, we wouldn’t be surprised to see them dumped on Binance overnight, crashing the whole market. Remember, these are the same people who promised to end a war in 24 hours.

That said, the token did introduce many people to crypto. According to NFTevening, 1 in 7 surveyed Americans bought $TRUMP. For 42%, it was their first crypto investment ever.

In short, $TRUMP — much like Trump himself — is controversial and unpredictable. Whether that was the plan all along is anyone’s guess. The final chapter of this memecoin saga is yet to be written — especially now that the entire crypto market is reacting to China’s ChatGPT alternative.

Editor’s Experience: Trading $TRUMP

Of course, we couldn’t ignore a phenomenon like $TRUMP. So how did it go?

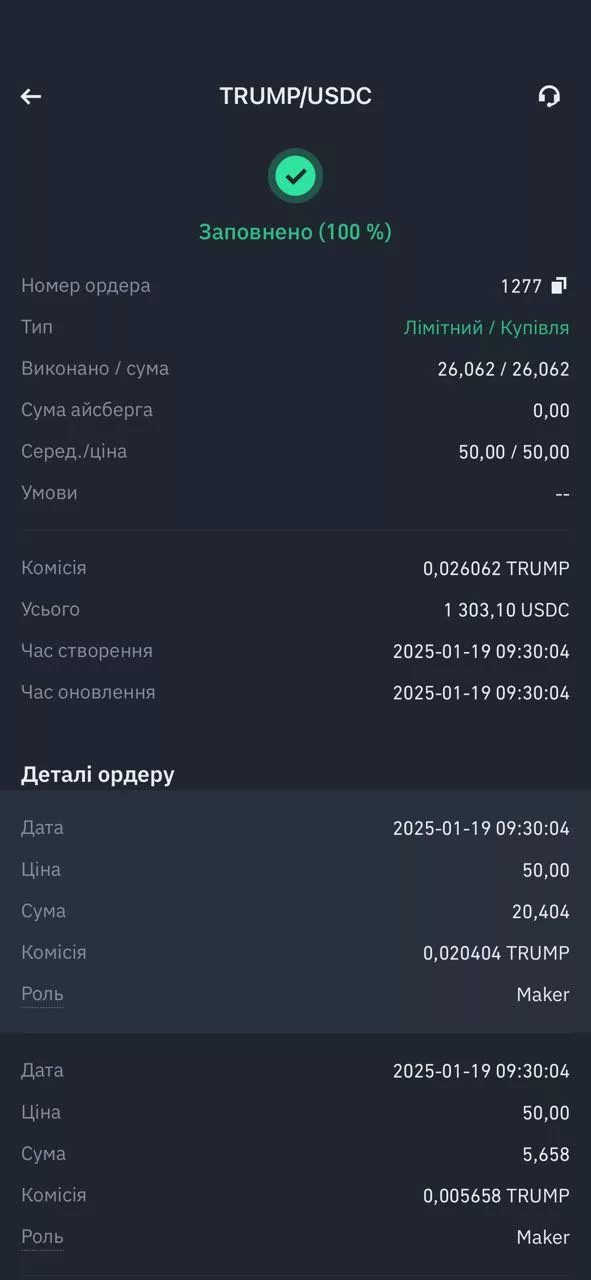

On January 19, news broke that $TRUMP was getting listed on Binance spot (it was already tradable on futures). Before the listing, its price was around $46–48. I placed an order at $50 in anticipation of the listing pump.

This was a calculated all-in. I was sure a Binance listing would boost the price — the only question was, how high? I sold off other assets, even at a loss (not something I normally recommend), to jump in.

I sold NEAR, WIF, and PEPE — all losers at the time. I kept my SOL though, since it was pumping hard alongside $TRUMP. Still, FOMO got me. Here’s why.

I invested $1300 into $TRUMP. The community expected it to hit $100, so I set my personal sell target at $80.

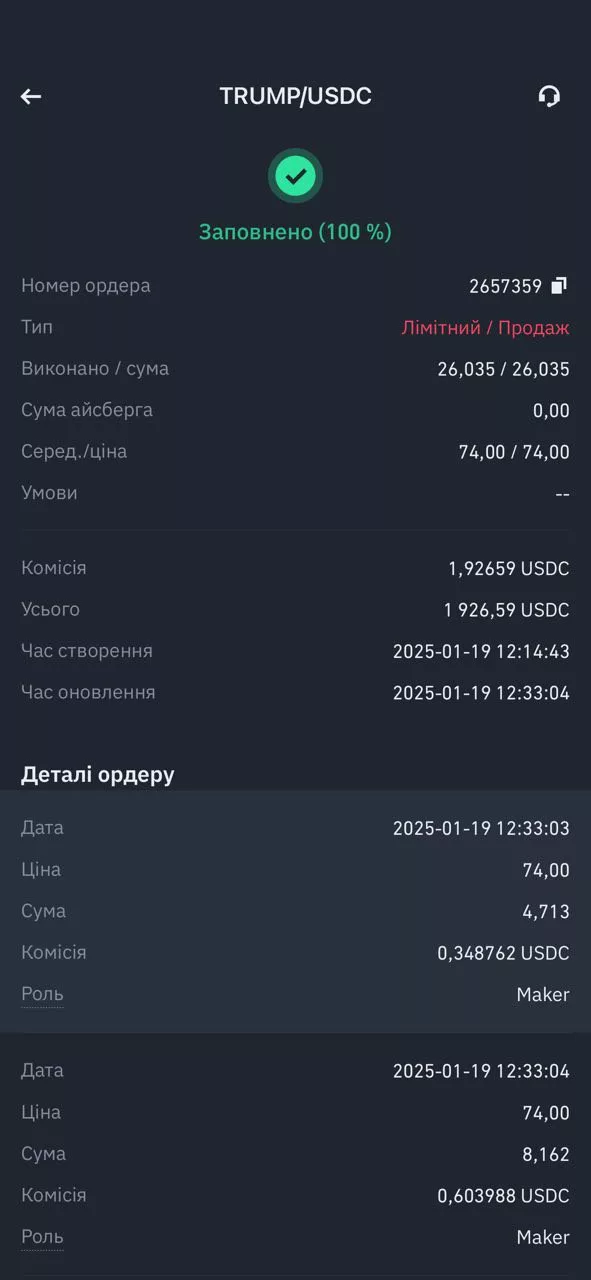

When the price first hit $78 (which turned out to be its ATH), it quickly fell back to the pre-listing range of $48–50. Clearly, the hype wasn’t enough for long-term confidence.

My strategy: wait for the price to retest resistance, then sell slightly below ATH. I set a sell order at $74. It hit $76 — and hasn’t seen $70 since.

Net profit: $626. Total: $1900 — just enough to buy that beauty you see above.

Moral of the story? Speculation money spends just like a regular paycheck. The key is to keep your head, have a plan, and stick to it. That’s how you earn — and play STALKER 2 on ultra settings. Wishing you all the same!

Conclusion

So is Trump truly pro-crypto? Probably yes — but his approach is… unconventional. While others build blockchain infrastructure, Trump bets on hype and speculation.

But dig a little deeper. While the public buys $TRUMP, Trump’s World Liberty Financial fund is reportedly buying Ethereum — not Solana, even though that’s where $TRUMP was launched. Presidential diversification at its finest.

Some analysts say $TRUMP’s pump hinted at an upcoming altcoin season. The logic: profits from $TRUMP would get reinvested into other assets, shifting attention away from BTC. That hasn’t happened yet — but who knows what’s next?

What do you think? Did you grab some $TRUMP? Share your take in our Telegram community — we’ve got a whole crypto thread waiting for you. And don’t forget to follow our second channel, CryptoGeek, for crypto news, airdrops, and more!

Respectfully yours — Geek!