Welcome, community! Do you understand the laws by which Bitcoin evolves and exists? Today, we’ll delve into an extremely important process known as halving. What is this process, and what could it lead to? Find out in our fresh overview.

Before we start, remember that crypto is not just an investment opportunity, but also a separate vertical in affiliate marketing. We have already written about why it is worth directing efforts towards cryptocurrency and what the competition is like there, so we highly recommend getting acquainted with that!

What is Halving?

If you have even a basic understanding of how the economy works, you probably know what inflation is. In short, it is the process where currency loses its value because more of it is being printed. Each currency has a different inflation rate. But have you ever wondered how this works with cryptocurrency?

Cryptocurrency also follows its own set of laws. Obviously, if Bitcoin could be mined continuously, it would eventually lose value. However, we observe the opposite trend. Certainly, there are significant drops, even very substantial ones. But many factors play a role here, including plain old dumping.

But the rate at which it increases every four years—surprising and motivating nearly every major business existing today to invest in cryptocurrency—is because obviously, when Bitcoin first significantly increased in value, it was still quite an underground thing; the second time, it had already attracted public attention; and the third time, it turned into a mainstream phenomenon, began to be implemented as a working currency in some countries, or at least became legalized and established there. And now, no more tales of a “bubble” which everyone who was interested in cryptocurrency back in 2017 heard about. Back then, skepticism towards Bitcoin was almost at its peak.

The reason why the cryptocurrency market changes every four years, and coins, especially Bitcoin, surge dramatically, is due to halving. Halving is a predictable event during which the reward for mining is significantly reduced (by half). For instance, at the beginning of its existence, a miner could receive 50 Bitcoins as a reward for mining one block in the blockchain, but today this amount is 6.25 BTC. After the upcoming halving, the reward for a mined block will be 3.125 BTC.

Halving is one of the key tools for controlling Bitcoin inflation. Additionally, it is a necessary condition to manage the supply volume. The limit of Bitcoin set by Satoshi Nakamoto, the creator of Bitcoin, is almost the main guarantee that Bitcoin will continue to be of high value.

A reminder that the Bitcoin limit set by Satoshi Nakamoto is 21 million. Currently, over 19 million BTC have been mined, and by 2030 only 3% of the total number of Bitcoins that can be obtained through mining will remain. Accordingly, to stretch this process while maintaining interest in Bitcoin and demand, there is halving. It is meant to help ensure that the last fraction of Bitcoin will not be mined until the end of 2078.

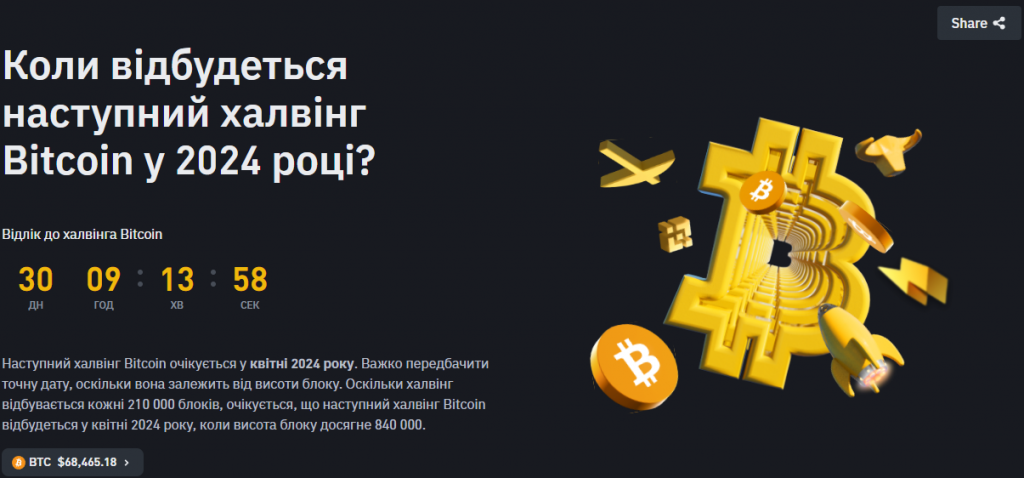

When Will the Bitcoin Halving Occur in 2024?

This year, we expect a halving. It is scheduled to happen quite soon, specifically in May.

On the Binance site, a corresponding counter has even been implemented, thanks to which you will definitely not miss the upcoming halving. To find it, just click on the screenshot above.

The main factor that affects when the next halving occurs is the number of mined blocks. Indeed, the reward is halved every 210,000 blocks. Considering this, one can quite accurately calculate when the next halving will occur.

What Will the Halving Affect?

Let’s talk about the consequences. The main reason you are probably reading our review is the price of Bitcoin. How much will it change? Binance mentioned above best answers this.

As we can see, the most significant growth, in percentage terms, occurred after the first and third halving. But note that Bitcoin is still rising. If during 2020, when the last halving occurred, it rose almost twice, from $8,600 to $15,700, at the time of writing our material, the value of one BTC is $51,500. Therefore, we can conclude that Bitcoin appreciates not only during the halving but also thereafter.

There’s nothing surprising about this. Due to the significant reduction in the rate of Bitcoin mining, the dynamics of supply and demand change. A deficit traditionally increases the value not only of Bitcoin but also of altcoins. Therefore, for those who were still hesitant to invest in Bitcoin, now is almost the best moment to buy BTC.

Summarizing

However, it’s important to understand that all forecasts you might hear from any source are based solely on how the industry reacted to each previous halving. Is it logical to assume that this year’s trend will not change? Yes. But do the results of past halvings guarantee that this year we will witness unprecedented growth in Bitcoin? It’s unlikely anyone can answer that with 100% certainty.

If you don’t want to wait for the halving alone, then drop by our Telegram community. There, you will find only the latest info, interesting discussions, and incredible people!

As always, with respect, your Geek!

Comments